jefferson parish property tax records

Search By Tax Year Payments are processed immediately but may not be reflected for up to 5 business days. You can contact the Jefferson Parish.

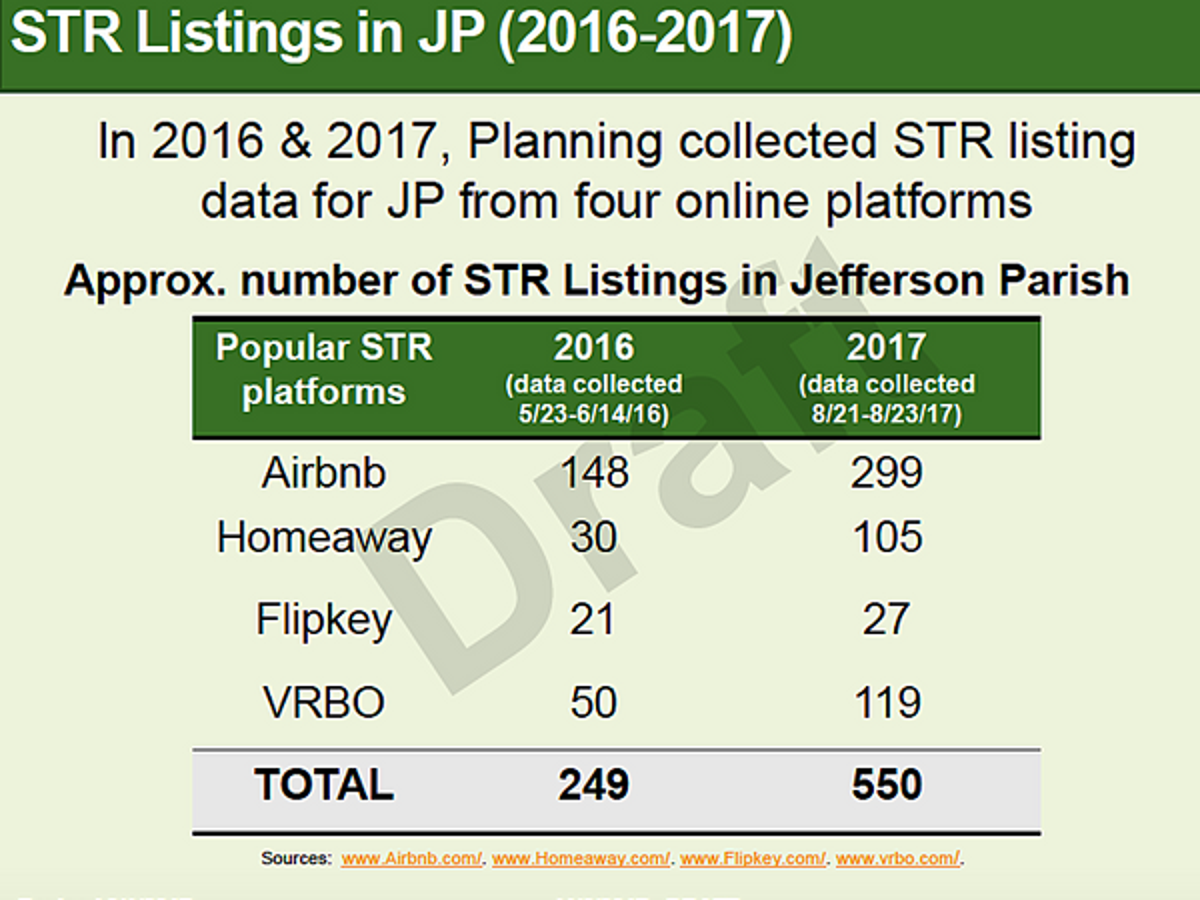

Extra Income Or Neighborhood Nuisance Short Term Rental Rules Weighed In Jefferson Parish Local Politics Nola Com

Property Tax The Jefferson County Sheriffs Office is the primary property tax collector for state metro Louisville district school fire and other special district taxes.

. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Select one of the.

Jefferson Parish makes no warranty as to the reliability. All Jefferson Parish Public Records Louisiana Nearest Airport. What is the property tax for 662 Dodge Avenue.

Jefferson parish property tax search. The Jefferson Parish Assessor is responsible for appraising real estate and assessing a property tax on properties located in Jefferson Parish Louisiana. When and how is my Personal Property assessed and calculated.

Jefferson Parish Code of Ordinances Section 2-151 requires the Parish. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website. Jefferson Parish Health Unit - Metairie LDH.

Public Records Request Public Works Service Request Sanitation Complaint Mosquito Stagnant Water Litter Trash Complaint. Drop Box checks only Jefferson Parish Sheriffs Office. In the year 2021 the property tax was 1779.

Our office is open for business from 830 am. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street Suite 1200. You may call or visit at one of our locations listed below.

Jefferson Parish collects on average 043 of a propertys. Property tax bills may be remitted via mail hand-delivery or paid online at our website. Uncover Available Property Tax Data By Searching Any Address.

2022 Assessor Property Records Search Jefferson County CO. Table of Contents. Jefferson Parish LAT-5 forms are due 45 days after receipt.

Jefferson Parish Assessors Office - Property Search. When property is bought and sold the Assessors office records the transfer of the property to reflect the most current owner in preparation for the annual assessment roll. Before you start here are a few things you should know about this application.

The report is intended to help Jefferson Parish voters make an informed decision on whether to approve a. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website. For a tax research certificate for purposes of LA RS.

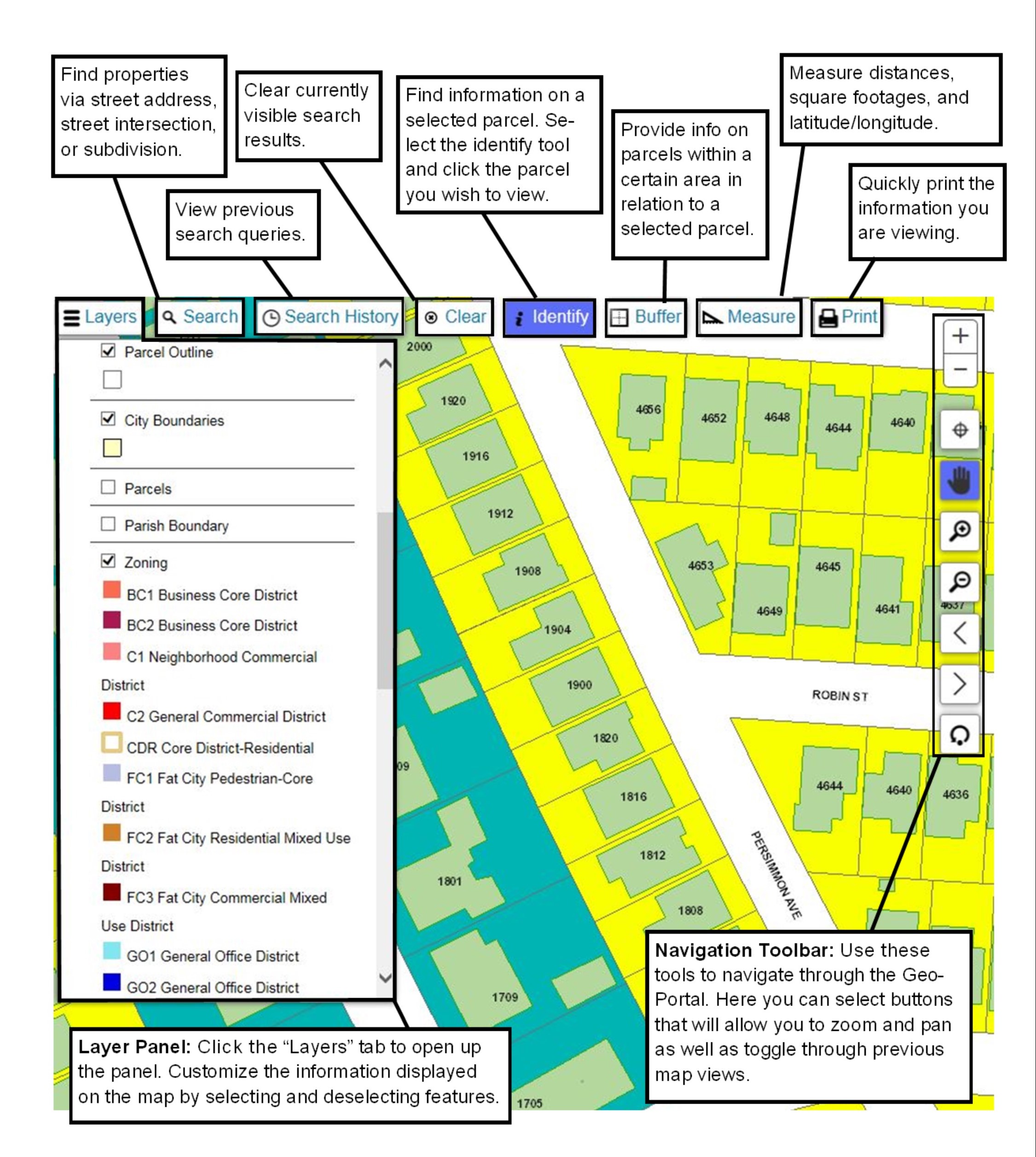

Welcome to the Treasurer Property Tax Records and Payment Application. Jefferson Parish has developed a Geographic Information Systems GIS database using aerial photography and field investigations. Property Tax Payment Options Hotel Occupancy Tax Vehicle Inventory Tax Tax Certificates.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. The assessment date is the first day of January of each. Tax Assessor-Collector of Jefferson County Texas.

3 rows Jefferson Parish Code Enforcement Offices. Ad Type In A Name State To Search Tax Lien Property Records Tax Evasion Records More. Jefferson Parish Assessors Office - Property Search.

Only open from December 1 2021 - January 31 2022. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. Get Property Records from 2 Code Enforcement.

Monday April 25 2022.

California County Map Large Printable And Standard Map Whatsanswer County Map California Map San Bernardino County

Payments Jefferson Parish Sheriff La Official Website

November Election Results For Jefferson Parish Wwltv Com

Property Tax Overview Jefferson Parish Sheriff La Official Website

What Jp Residents Need To Know To Pay Property Tax

E Services Jefferson Parish Sheriff La Official Website

Jefferson Parish Property Tax Bills Are In The Mail Local Politics Nola Com

Payments Jefferson Parish Sheriff La Official Website

Elevation Grant Kickoff Meeting